ETH Price Prediction: Path to $5,000 Strengthened by Technicals and Institutional Demand

#ETH

- Technical Momentum: MACD bullish divergence and price holding above key support levels indicate strengthening upward potential

- Institutional Demand: Major corporate purchases and treasury strategies providing substantial buying pressure and reducing circulating supply

- Market Sentiment: Positive news flow around institutional adoption overcoming short-term volatility concerns, creating favorable conditions for price appreciation toward $5,000

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Support

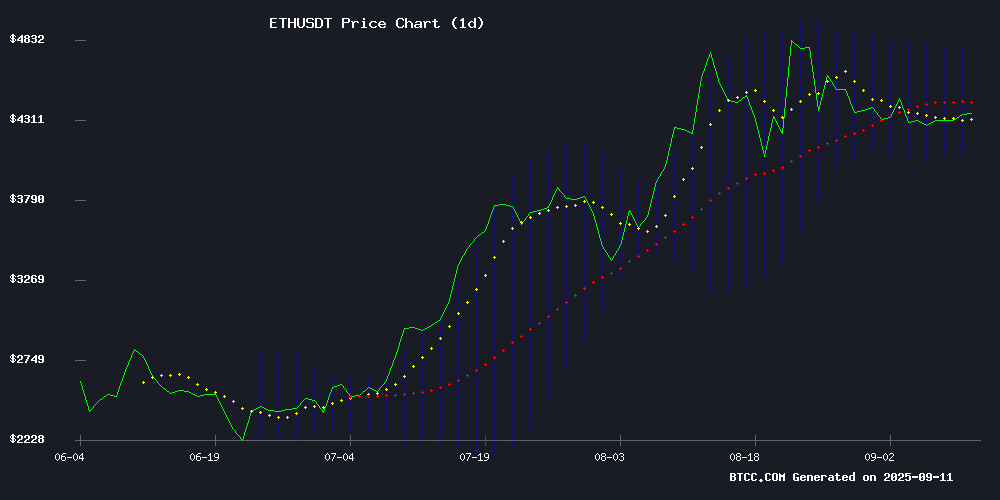

ETH is currently trading at $4,409.60, slightly below the 20-day moving average of $4,416.51, indicating near-term consolidation. The MACD reading of 64.33 suggests strong bullish momentum, while Bollinger Bands show price action within normal ranges with upper resistance at $4,709.05 and support at $4,123.97. According to BTCC financial analyst Emma, 'The technical setup remains constructive with ETH holding above critical support levels. The MACD divergence and current positioning relative to Bollinger Bands suggest potential for upward movement toward the $4,500 resistance zone.'

Market Sentiment: Institutional Accumulation Supports ETH Bull Case

Recent news flow strongly supports bullish sentiment for Ethereum. Major developments include BitMine's $200 million ETH purchase bringing their holdings NEAR $10 billion, multiple institutional treasury strategies being implemented, and Ethereum's steady performance above $4,200 support. BTCC financial analyst Emma notes, 'The institutional adoption narrative continues to strengthen with significant corporate buying. While short-term volatility from events like the Linea token sell-off exists, the underlying institutional demand and developer commitment to Ethereum's future provide solid fundamental support for price appreciation.'

Factors Influencing ETH's Price

SharpLink's Ethereum Treasury Strategy Touted as Institutional Gateway

SharpLink Gaming's $3.7 billion Ethereum treasury accumulation is positioning itself as a catalyst for institutional adoption, with co-CEO Joseph Chalom dismissing bearish comparisons to past crypto collapses. "This isn't another FTX scenario—it's a white swan event," Chalom told Decrypt, emphasizing the company's regulated transparency as a blueprint for traditional firms.

The gaming firm's strategy spotlights Ethereum's role in tokenization and stablecoin infrastructure, with Chalom predicting inevitable adoption by major corporations. Public company disclosures create what he calls a "blueprint effect," demystifying crypto for institutional players still on the sidelines.

Ethereum Price Prediction: Will ETH Break $4,500?

Ether's price remains volatile, caught between macroeconomic pressures and optimism around potential ETF approvals. The cryptocurrency narrowly avoided a drop below $4,200—a level that would have triggered $600 million in liquidations—and now hovers near $4,425.

Resistance at $4,500 serves as the next critical threshold. A decisive breakout could propel ETH toward $4,800-$5,000, fueled by ETF speculation and DeFi growth. Conversely, failure to hold $4,200 may invite a cascade of sell-offs, with downside targets at $4,000-$3,600.

Market sentiment appears bifurcated: bulls point to institutional interest and Ethereum's deflationary supply mechanics, while bears highlight regulatory uncertainty and broader risk-off conditions. The $4,400-$4,500 zone has become a battleground, with trading volumes suggesting heightened institutional participation.

Linea Token Plummets 27% Amid Airdrop Controversy and Whale Sell-Offs

Linea, Ethereum's Layer-2 scaling solution, faces a turbulent debut as its LINEA token crashes 27% to $0.023. The drop follows a botched airdrop that favored Binance users, leaving 750,000 wallets delayed in claiming their 9.36 billion tokens. Whales capitalized on the uneven distribution, triggering panic selling.

Community outrage erupted after revelations that the airdrop contract was funded late, enabling exchange users to dump tokens first. Critics like @SSjCosmoCrypto derided LINEA as a "memecoin with no utility," questioning its incentive structure. The sell-off accelerated as early backers exited en masse.

Ethereum Core Developers Sacrifice Market-Rate Salaries for Network's Future

Ethereum's core developers are earning significantly less than their market value, according to a new compensation report from the Protocol Guild. The survey reveals that most contributors receive just $157,939 annually—60% below the industry average of $359,074 for comparable roles in competing firms.

These developers operate with minimal equity or token incentives, while traditional tech companies offer median equity grants of 7%. Nearly 40% of respondents reported receiving higher-paying job offers in the past year, yet many choose to remain committed to Ethereum's decentralized vision.

"They're selfless people working under financial strain," said Ethereum developer Phil Ngo. The sacrifice reflects a shared belief in building alternatives to traditional finance systems—even as talent competition intensifies across the blockchain sector.

Ethereum Validators Slashed for Double-Signing in Major Beacon Chain Penalty Event

Ethereum's Beacon Chain enforced significant slashing penalties on September 10, with 40 validators collectively losing over $52,000 in ETH for violating consensus rules. Initial reports implicated StakeFi, Allnodes, and SSV Network, but blockchain forensics revealed Ankr-linked operators bore the brunt of the sanctions.

The automated penalties—triggered by conflicting attestations—extracted 0.3 ETH (~$1,300) per validator. Core developer Preston Vanloon attributed the incident to probable key management failures during validator migrations, where duplicate signing occurred across environments. "These validators published contradictory attestations," Vanloon stated, emphasizing that slashed nodes must remain active until formally exited to avoid compounding penalties.

Ethereum Shows Signs of Breaking Sideways Trend Amid Institutional Revival

Ethereum's prolonged consolidation phase may be nearing its end as institutional interest resurfaces. BlackRock's $44.2 million ETH ETF inflow on Tuesday marked the first positive movement after eleven consecutive days of outflows, with Grayscale contributing an additional $16.6 million the following day.

The cryptocurrency has demonstrated remarkable resilience, maintaining its $4,300 support level throughout September's market fluctuations. Bitmine's $44 million ETH acquisition underscores growing institutional confidence, while network fee activity suggests impending on-chain momentum.

Technical indicators reveal bearish exhaustion following August's correction, with ETH's RSI stabilizing at the 50% threshold. This equilibrium often precedes trend reversals when accompanied by fundamental catalysts like the current ETF inflows.

Scroll DAO Pauses Governance Amid Leadership Reshuffle and Redesign

Scroll's decentralized autonomous organization (DAO) is temporarily halting its governance process following leadership resignations and confusion over active proposals. The decision emerged during a Wednesday delegate call, with co-founder Haichen Shen citing a need to "redesign governance." Contributor Raza clarified the move as a "pause," not a full stoppage.

The DAO's structure, which operates via blockchain-coded smart contracts and tokenholder voting, now faces uncertainty. Eugene, a key leadership figure, resigned this week, leaving the team unable to confirm which proposals remain active—including a treasury management measure. Delegates, who vote on behalf of passive tokenholders, await clarity as Scroll seeks time to "put everything in order."

Early signals suggest a shift toward centralized control during the redesign. The pause leaves unresolved questions about honoring pending decisions and the future balance of power within the Ethereum Layer 2 project.

BitMine Expands ETH Treasury with $200M Purchase, Nearing $10B in Holdings

BitMine Immersion Technologies has aggressively expanded its Ethereum reserves, adding 46,255 ETH worth approximately $200 million in its second major purchase this week. The Nevada-based firm, originally a crypto miner, now holds 2.116 million ETH valued at over $9.2 billion—representing 1.75% of Ethereum's circulating supply.

The latest acquisition was identified by blockchain analytics platform Lookonchain, which tracked three separate transactions executed via BitGo. BitMine's cumulative purchases this week total $250 million, including a separate 56,545 ETH buy. Public companies collectively hold 3.62 million ETH, with BitMine maintaining its position as the largest institutional holder.

This strategic accumulation underscores growing institutional confidence in Ethereum's long-term value proposition. The purchases coincide with Ethereum's ongoing transition to proof-of-stake and its evolving role as institutional-grade digital infrastructure.

Ethereum Steady as Market Eyes $4,500 Break for Uptrend

Ethereum holds steady at $4,361, with a 1.85% gain in the past 24 hours, as investors await clearer signals amid delays in BlackRock's spot ETF approval. Trading volume stands at $38 billion, reflecting cautious optimism in the market.

Technical indicators paint a mixed picture. The RSI hovers near neutral, while the MACD shows bearish momentum tapering—a potential sign of accumulating buyer interest. Key levels to watch: a breakout above $4,500 could confirm an uptrend, while failure to hold $4,250 may trigger renewed selling pressure.

The SEC's decision to delay staking provisions for BlackRock's Ethereum ETF has dampened short-term bullish momentum. Market participants had anticipated the ETF to catalyze upward movement, but regulatory hurdles have forced consolidation. Crypto analysts note this development introduces near-term uncertainty, though institutional interest remains a structural tailwind.

Ether Holds Strong Above $4,200 Support, Eyes Higher Targets

Ether (ETH) demonstrates resilience after a brief dip, reclaiming the $4,300 level following a drop to $4,200 earlier this week. The recovery signals renewed optimism among traders as the broader cryptocurrency market experiences mixed movements.

Technical indicators suggest a bullish outlook, with the Relative Strength Index (RSI) at 50 on the 4-hour chart and MACD lines converging in the bullish zone. Analysts highlight the $4,200 support level as a critical factor, indicating potential for further upside.

Ether's ability to maintain above $4,000 since its August all-time high of $4,953 underscores its strength amid market volatility. Momentum appears to be shifting back in favor of buyers as the coin trades above $4,300.

Nasdaq-listed Bitmine Purchases $201M ETH, Ethereum Price Today Hits $4,400

Bitmine Immersion Technologies, a Nasdaq-listed company, has made a significant move in the cryptocurrency market by acquiring 446,255 ETH worth approximately $201 million. This purchase, completed on September 10 through custodian BitGo, solidifies Bitmine's position as the largest corporate holder of Ethereum globally.

The announcement triggered a nearly 3% surge in ETH's price, pushing it above $4,410. Bitmine's aggressive accumulation strategy now gives the company control over 2,126,018 ETH, valued at nearly $9.3 billion. Chairman Thomas Lee's vision appears to be positioning the firm to eventually own 5% of Ethereum's total supply.

This institutional endorsement comes as Ethereum continues to gain mainstream adoption, with its price reflecting growing confidence among major investors. The purchase underscores the increasing institutional interest in cryptocurrency as a core treasury asset.

Will ETH Price Hit 5000?

Based on current technical indicators and market developments, ETH has a strong probability of reaching $5,000 in the medium term. The combination of bullish technical signals, including positive MACD momentum and solid support levels, coupled with accelerating institutional adoption through major purchases like BitMine's $200 million acquisition, creates favorable conditions for upward movement.

| Indicator | Current Value | Signal |

|---|---|---|

| Price | $4,409.60 | Neutral/Bullish |

| 20-day MA | $4,416.51 | Slight Resistance |

| MACD | 64.33 | Bullish |

| Bollinger Upper | $4,709.05 | Near-term Target |

| Support Level | $4,123.97 | Strong Foundation |

BTCC financial analyst Emma emphasizes that 'While $5,000 represents a significant psychological barrier, the current technical and fundamental backdrop suggests this level is achievable, particularly if institutional accumulation patterns continue and the market maintains its current risk-on sentiment toward digital assets.'